irvine income tax rate

What is the sales tax rate in Irvine California. Irvine income tax rate Wednesday February 16 2022 Edit.

Top Tax Rate On Personal Income Would Be Highest In Oecd Under New Build Back Better Framework Income Tax Rate Income Tax

California Income Tax Rate.

. At 158 percent it would be. The US average is 73. Irvine income tax rate Saturday February 26 2022 Edit.

The average cumulative sales tax rate in Irvine California is 775. Here is the table with the State Income Taxes in the state of California. The state income tax rates range from 1 to 123 and the sales tax rate is 725 to 1075.

As a way to measure the quality of schools we analyzed the math and. The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA.

100 - 1330 Median household income in California. The US average is 46. The state of Californias income tax rate is 1 to 123 the highest in the US.

The sales tax rate in Irvine California is 78. A combined city and county sales tax rate of 175 on top of Californias 6 base makes University Park Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities. - Tax Rates can have a big.

Irvine is located within Orange County California. California income tax rate. A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a.

Tax Rates for Irvine - The Sales Tax Rate for Irvine is 60. Census Bureau Number of cities that have local income taxes. Heres how taxes affect the average cost of living in Irvine CA.

The US average is 73. Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan Realtymonks One Stop Real. The minimum combined 2022 sales tax rate for Irvine California is.

We have info about recent selling dates and prices property transfers and the top-rated. Whether youre preparing personal taxes or small business taxes completing it yourself can be a serious burden and put you at risk for missed deductions. 30 rows Tax Rates for Irvine - The Sales Tax Rate for Irvine is 78.

This includes the rates on the state county city and special levels. - The Income Tax Rate for Irvine is 71. Last year the average property taxes paid was 07 Irvine California.

Income Taxes and Preparation. Detailed California state income tax rates and brackets are available on this page. This is the total of state county and city sales tax rates.

We Specialize In Non Qm Loans And Has Great Solutions For People That Have An Individual Tax Identification Number It Home Ownership Home Buying The Borrowers

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

Why Households Need 300 000 To Live A Middle Class Lifestyle

Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan

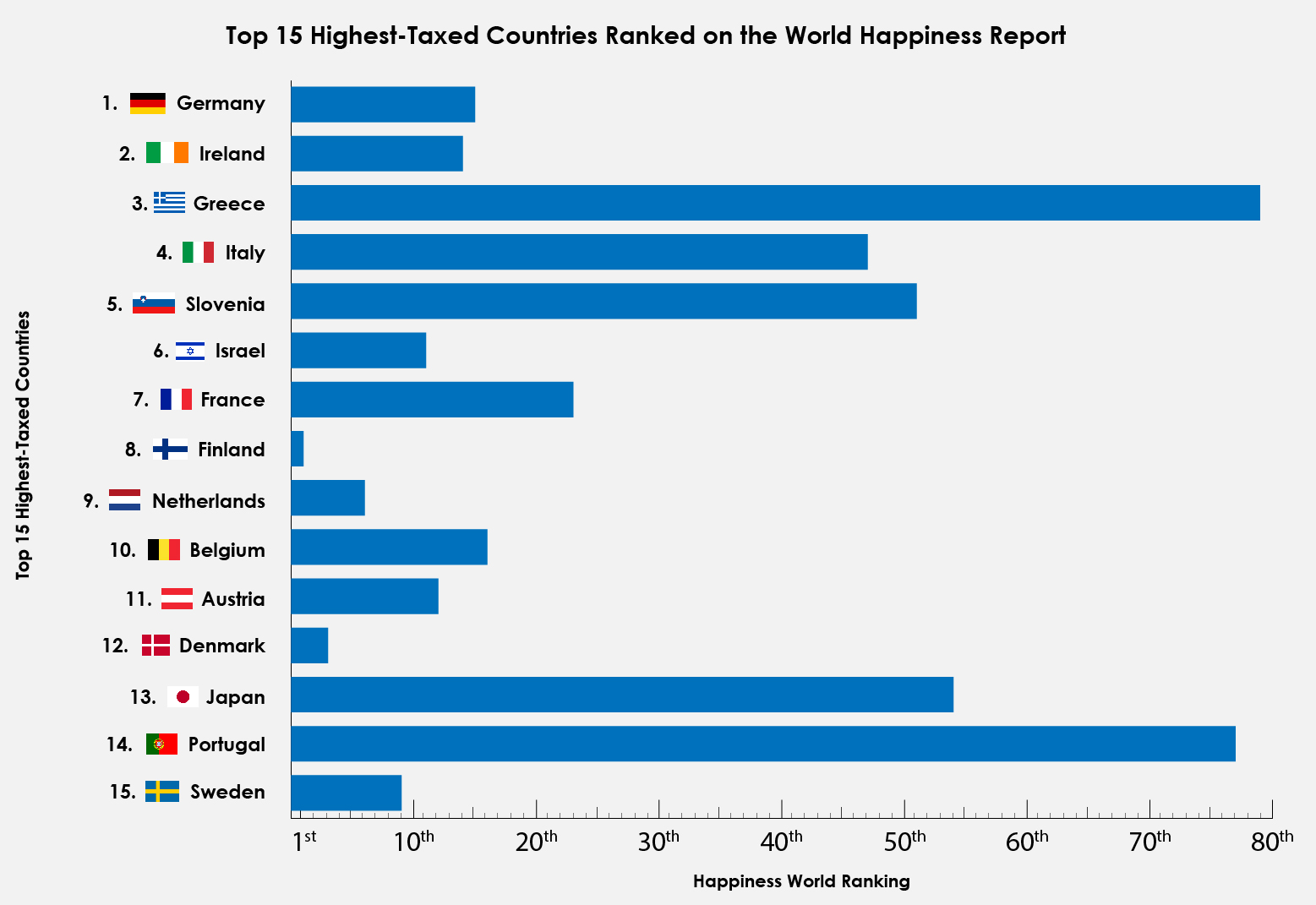

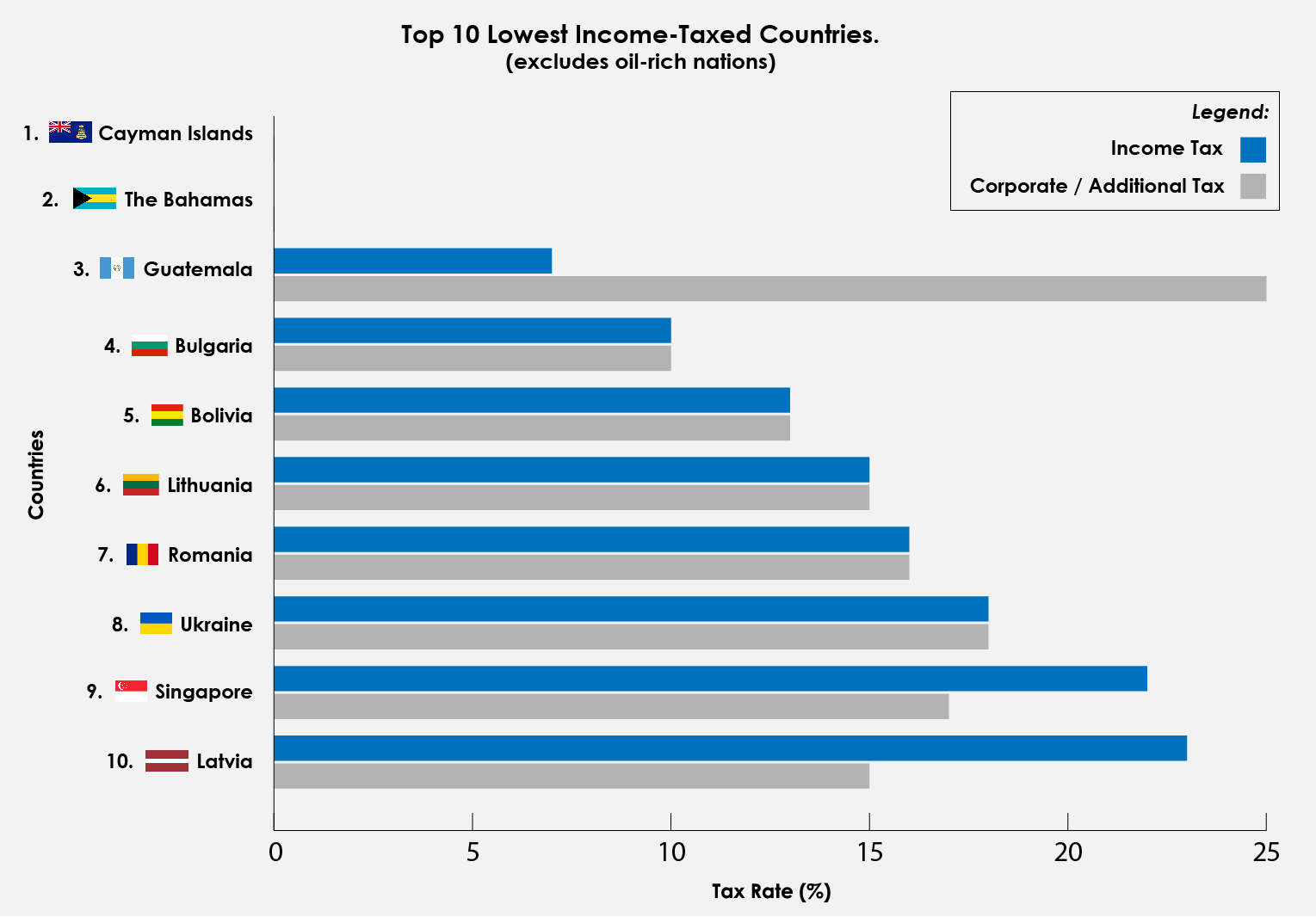

Does Lower Income Tax Make A Happier Country

Pin On Tax Relief And Legal Updates

Why Households Need 300 000 To Live A Middle Class Lifestyle

Mortgage Payoff Watches Mortgage Payoff Refinancing Mortgage Mortgage Interest Rates

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

15 Self Employment Tax Deductions In 2022 Nerdwallet Capital Gains Tax Income Tax Brackets Income Tax Return

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Understanding California S Property Taxes

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

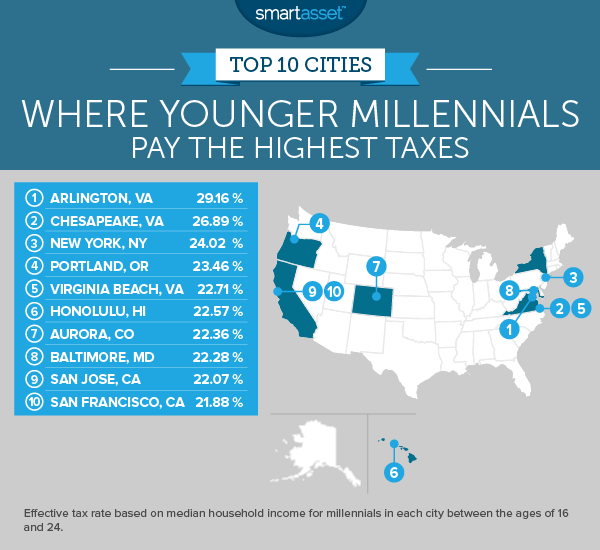

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Does Lower Income Tax Make A Happier Country

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset